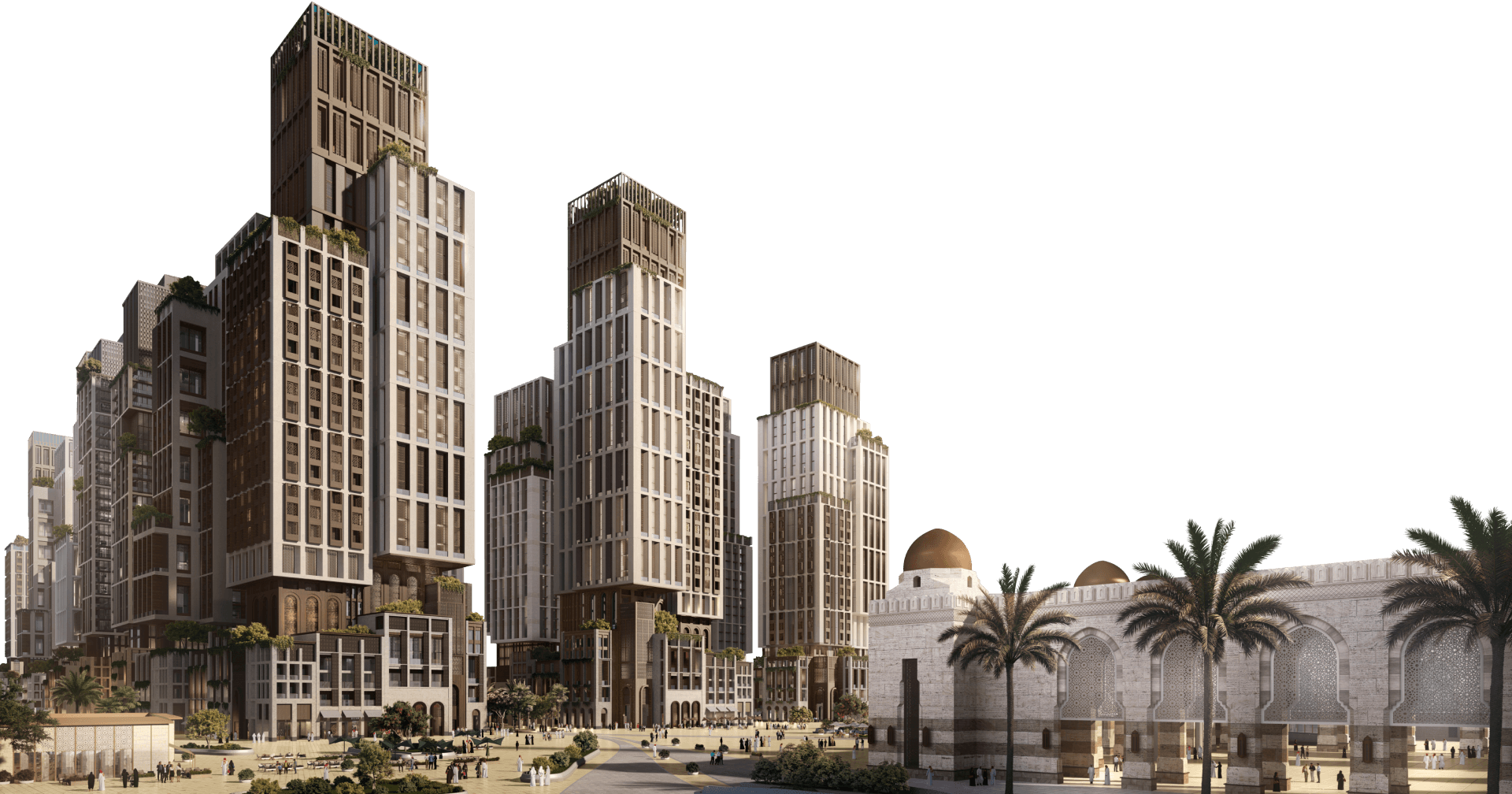

Creating a destination in Makkah Al Mukarramah, offering unparalleled experiences

About MASAR Destination

Offering unparalleled experiences and modern hospitality to inspire every journey

MASAR is one of the largest redevelopment projects in the region. It is located directly on Makkah's western border, stretching for more than 3.5km from the third Ring Road intersection to 550 meters from Al Haram’s King Fahad Gate. The project is directly accessible through Prince Mohammed bin Salman bin Abdulaziz Road.

MASAR aims to create a global multi-use destination to serve the residents and visitors of Makkah. It will include a number of key components, including hotel rooms, serviced apartments, residential apartments, shopping malls, healthcare centers and offices.

As of November 2024, 99.77% of the key infrastructure works had been completed.

MASAR is one of the largest redevelopment projects in the region. It is located directly on Makkah's western border, stretching for more than 3.5km from the third Ring Road intersection to 550 meters from Al Haram’s King Fahad Gate. The project is directly accessible through Prince Mohammed bin Salman bin Abdulaziz Road.

MASAR aims to create a global multi-use destination to serve the residents and visitors of Makkah. It will include a number of key components, including hotel rooms, serviced apartments, residential apartments, shopping malls, healthcare centers and offices.

As of November 2024, 99.77% of the key infrastructure works had been completed.

The Initial Public Offering

A new chapter of expansion and transformation

Transaction Timeline

Investment Highlights

Located in one of the most attractive destinations with perpetual demand as the permanent capital of the Muslim world

- Makkah is an attractive destination with sustained demand. The total number of visitors to Makkah is expected to reach more than 42 million by 2030G, representing a significant 2.6-fold increase compared to the actual figures recorded in 2019G.

- A draft real estate ownership law comprising articles dedicated to non-Saudis’ ownership of and investment in real estate was circulated on July 11, 2021G through a consultation platform, which, if implemented, could contribute to transforming Makkah into a global investment hub.

Low-risked business model uniquely positioned for the Makkah market

- Poised to be Makkah’s gateway location, addressing the city's mobility and infrastructure challenges, MASAR as a holistic destination offers unique experiences and an unparalleled breadth of offerings.

- MASAR serves as the ideal investment platform for Makkah, allowing Umm Al Qura to avoid the challenges of self-developing large projects. The Company has ensured low-risk execution through diverse development strategies and asset types within a unified system, with phased revenue streams to enable the reinvestment of capital.

Strong financial position with low leverage enabling a resilient business model

- A strong financial position with low leverage enables a resilient and flexible business model, well-planned to cover debt and financial obligations with a built-in operational cushion to minimize execution risk.

- As of June 30, 2024G, Umm Al Qura has a strong cash position of SAR 914.8 million and total assets of SAR 24.6 billion, in addition to an acceptable debt-to-equity ratio.

Distinguished management team with experience across multiple functions

- Umm Al Qura’s leadership have around 100 years of collective experience and comprise prominent figures in the real estate sector in the region, with special connections and experience in Makkah.

- The management team’s capabilities were validated through a disciplined execution strategy and the ability to gain the trust of the largest developers in Saudi Arabia. They are strongly committed to the project and believe in MASAR’s success.

Prominent and committed shareholder base

- Umm Al Qura benefits from its strong shareholder base comprising of a unique mix of public and private shareholders including prominent and committed government institutions such as GOSI and PIF.

- 60.8% of the company’s capital pre-IPO is owned by government entities and semi government entities.

- Most of the shareholders have invested in cash, and only a relatively small portion consisting of original owners have been compensated for their lands through an exchange of shares; out of the total capital of over SAR 13 billion, only SAR 2.9 billion represents in-kind contributions.

How to Subscribe

Frequently Asked Questions

What is the transaction structure?

On December 24, 2024G, the Capital Market Authority announced its approval of the Company’s application for the registration and offer of 130,786,142 Shares (the "Offer Shares", and each an "Offer Share"), representing 9.09% of the Company’s shares post capital increase through a capital increase.

How can I subscribe to the IPO?

If you are an institutional investor, please contact Albilad Capital, GIB Capital, AlRahji Capital and Alinma Invest as our appointed Joint Bookrunners and Underwriters.

If you are a retail investor, please submit a subscription application through any of the Receiving Agents listed here. You must have an investment account and active portfolio with one of these entities.

The prospectus can be downloaded from the “Useful Documents” section of this webpage. It contains detailed information to support you in making an informed decision.

We also recommend consulting with your personal financial advisor for any investment related queries.

Who is eligible to participate in the Offering?

The Offering shall be limited to the two following groups of investors:

(1) Participating Parties: This tranche comprises investors eligible to participate in the book building process in accordance with the Instructions for Book Building Process and Allocation Method in Initial Public Offerings, as issued by the Capital Market Authority.

(2) Individual Subscribers: This tranche includes Saudi nationals, including any Saudi female divorcee or widow with minor children from a marriage to a non-Saudi individual, who is entitled to subscribe for her own benefit in the names of her minor children, provided that she proves that she is a divorcee or widow and the mother of her minor children, any non-Saudi natural person who is resident in the Kingdom, or GCC nationals, in each case, who have an investment account and an active portfolio with one of the Receiving Agents and are entitled to open an investment account with a Capital Market Institution.

When will the Final Offer Price be announced?

The final price of the shares will be set after the institutional book-building process is complete.